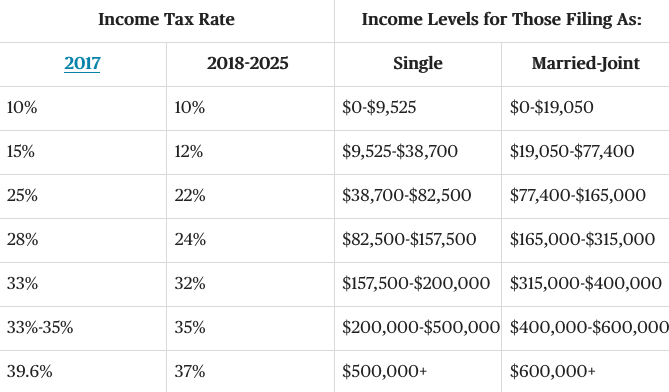

With the House & Senate passing the new tax bill and the President signing it into law on Friday, many have the simple question of whether they’ll be paying more or less with the new law.

A couple of the highlights (or in some cases lowlights) of the new tax bill include:

- Standard Deduction will nearly double. For Single Taxpayers, the deduction will increase from $6,350 to $12,000. For Married Filing Joint Taxpayers, deduction will increase from $12,700 to $24,000

- Elimination of the Personal Exemption Deduction: For 2017, the exemption was/is $4,050 per person.

- The child tax credit will double from $1,000 to $2,000 for each child under 17 years old. Up to $1400 of that will be refundable

- The AMT exemption will be increased

- Deduction for Taxes paid for State, City & Property Taxes will be capped at $10,000

- Mortgage interest will be deductible only on the first $750,000 of the loan. Interest on a Home Equity Line of Credit will no longer be deductible.

- Expansion of Permitted 529 Plans Distributions: Until now, these tax free distributions were limited to college tuition & expenses. Under the new law, it will be expanded to include tuition & expenses for private & religious schools with a cap of $10,000 per person/year.

- Corporate Tax Rate will be reduced from a maximum of 35% to a flat rate of 21%

- A new 20% Pass-Through deduction for income received from a sole proprietorship, partnership, or S-corporation

- The new tax laws won’t affect your 2017 return but these 4 moves might.

Will You Be Paying More or Less?

See what these new laws mean for you. MarketWatch has created a Trump Tax Plan Calculator to give you an estimate of what your tax liability will be with the new plan. Just remember, these taxes go into effect for your 2018 tax return (filing due date of April 2019)

Click Here to go to the Trump Tax Plan Calculator

For optimal results, pull out your filed 2016 tax return and input the requested totals in the tax calculator. When completed, compare the tax owed in the tax calculator with line 63 on your 2016 tax return. The tax calculator does not account for every single provision of the law but it should give you a basic idea of how it’ll affect you.

Stay Connected!

Follow @TJBDeals On Twitter

Like On Facebook!

@TJBDeals on Instagram

Join Our Whatsapp Group!

Get Alerts via SMS by Texting ‘Follow TJBDeals‘ to 40404

Join Our Telegram Channel!

Don’t Miss Another Deal! Get Instant Alerts Once Our Deals Go Public!

Don’t Miss Another Deal! Get Instant Alerts Once Our Deals Go Public!

Thought i was going to owe more money, apparently not